Page 26 - Exim iar24_Ebook

P. 26

EXIM BANK MALAYSIA

24

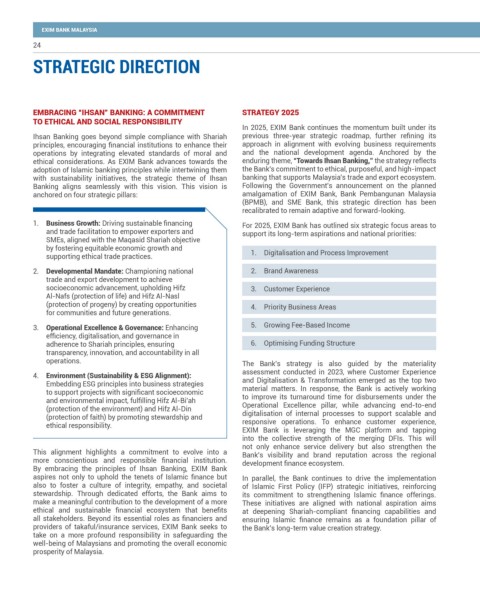

STRATEGIC DIRECTION

EMBRACING “IHSAN” BANKING: A COMMITMENT STRATEGY 2025

TO ETHICAL AND SOCIAL RESPONSIBILITY

In 2025, EXIM Bank continues the momentum built under its

Ihsan Banking goes beyond simple compliance with Shariah previous three-year strategic roadmap, further refining its

principles, encouraging financial institutions to enhance their approach in alignment with evolving business requirements

operations by integrating elevated standards of moral and and the national development agenda. Anchored by the

ethical considerations. As EXIM Bank advances towards the enduring theme, “Towards Ihsan Banking,” the strategy reflects

adoption of Islamic banking principles while intertwining them the Bank’s commitment to ethical, purposeful, and high-impact

with sustainability initiatives, the strategic theme of Ihsan banking that supports Malaysia’s trade and export ecosystem.

Banking aligns seamlessly with this vision. This vision is Following the Government’s announcement on the planned

anchored on four strategic pillars: amalgamation of EXIM Bank, Bank Pembangunan Malaysia

(BPMB), and SME Bank, this strategic direction has been

recalibrated to remain adaptive and forward-looking.

1. Business Growth: Driving sustainable financing For 2025, EXIM Bank has outlined six strategic focus areas to

and trade facilitation to empower exporters and support its long-term aspirations and national priorities:

SMEs, aligned with the Maqasid Shariah objective

by fostering equitable economic growth and

supporting ethical trade practices. 1. Digitalisation and Process Improvement

2. Developmental Mandate: Championing national 2. Brand Awareness

trade and export development to achieve

socioeconomic advancement, upholding Hifz 3. Customer Experience

Al-Nafs (protection of life) and Hifz Al-Nasl

(protection of progeny) by creating opportunities 4. Priority Business Areas

for communities and future generations.

3. Operational Excellence & Governance: Enhancing 5. Growing Fee-Based Income

efficiency, digitalisation, and governance in

adherence to Shariah principles, ensuring 6. Optimising Funding Structure

transparency, innovation, and accountability in all

operations. The Bank’s strategy is also guided by the materiality

4. Environment (Sustainability & ESG Alignment): assessment conducted in 2023, where Customer Experience

Embedding ESG principles into business strategies and Digitalisation & Transformation emerged as the top two

to support projects with significant socioeconomic material matters. In response, the Bank is actively working

and environmental impact, fulfilling Hifz Al-Bi’ah to improve its turnaround time for disbursements under the

(protection of the environment) and Hifz Al-Din Operational Excellence pillar, while advancing end-to-end

(protection of faith) by promoting stewardship and digitalisation of internal processes to support scalable and

ethical responsibility. responsive operations. To enhance customer experience,

EXIM Bank is leveraging the MGC platform and tapping

into the collective strength of the merging DFIs. This will

not only enhance service delivery but also strengthen the

This alignment highlights a commitment to evolve into a Bank’s visibility and brand reputation across the regional

more conscientious and responsible financial institution. development finance ecosystem.

By embracing the principles of Ihsan Banking, EXIM Bank

aspires not only to uphold the tenets of Islamic finance but In parallel, the Bank continues to drive the implementation

also to foster a culture of integrity, empathy, and societal of Islamic First Policy (IFP) strategic initiatives, reinforcing

stewardship. Through dedicated efforts, the Bank aims to its commitment to strengthening Islamic finance offerings.

make a meaningful contribution to the development of a more These initiatives are aligned with national aspiration aims

ethical and sustainable financial ecosystem that benefits at deepening Shariah-compliant financing capabilities and

all stakeholders. Beyond its essential roles as financiers and ensuring Islamic finance remains as a foundation pillar of

providers of takaful/insurance services, EXIM Bank seeks to the Bank’s long-term value creation strategy.

take on a more profound responsibility in safeguarding the

well-being of Malaysians and promoting the overall economic

prosperity of Malaysia.