Page 27 - Exim iar24_Ebook

P. 27

EXIM BANK MALAYSIA ANNUAL REPORT 2024

3 MANAGEMENT DISCUSSION & ANALYSIS 25

In 2025, EXIM Bank is placing emphasis on Halal trade opportunities within ASEAN, coinciding with Malaysia’s ASEAN

Chairmanship. According to the Department of Statistics Malaysia (DOSM), four of Malaysia’s top ten export markets are ASEAN

nations, contributing 29% of total exports. The Bank is also exploring Central Asia as an emerging strategic market, given its

geographic connectivity and resource-rich profile. Complementing the Government’s push to promote Malaysian-made products

and services on the international stage, EXIM Bank is also intensifying its presence in Africa and the Middle East, supporting

businesses in expanding their global footprint.

Further, the Bank is expanding its trade finance offerings, including enhancing the Export Credit Refinancing (ECR) product for

participating banks. By improving the product’s attractiveness and accessibility, the Bank aims to increase utilisation, helping

businesses overcome liquidity constraints, manage trade risks, and access new markets which ultimately contribute to increased

exports, job creation, and national trade efficiency.

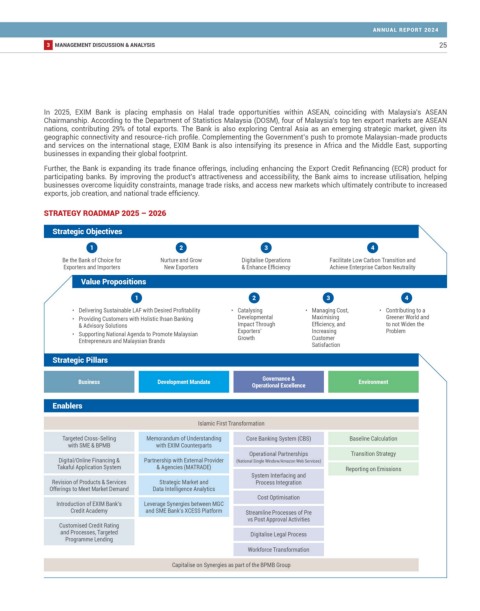

STRATEGY ROADMAP 2025 – 2026

Strategic Objectives

1 2 3 4

Be the Bank of Choice for Nurture and Grow Digitalise Operations Facilitate Low Carbon Transition and

Exporters and Importers New Exporters & Enhance Efficiency Achieve Enterprise Carbon Neutrality

Value Propositions

1 2 3 4

• Delivering Sustainable LAF with Desired Profitability • Catalysing • Managing Cost, • Contributing to a

• Providing Customers with Holistic Ihsan Banking Developmental Maximising Greener World and

& Advisory Solutions Impact Through Efficiency, and to not Widen the

• Supporting National Agenda to Promote Malaysian Exporters’ Increasing Problem

Entrepreneurs and Malaysian Brands Growth Customer

Satisfaction

Strategic Pillars

Governance &

Business Development Mandate Environment

Operational Excellence

Enablers

Islamic First Transformation

Targeted Cross-Selling Memorandum of Understanding Core Banking System (CBS) Baseline Calculation

with SME & BPMB with EXIM Counterparts

Operational Partnerships Transition Strategy

Digital/Online Financing & Partnership with External Provider (National Single Window/Amazon Web Services)

Takaful Application System & Agencies (MATRADE) Reporting on Emissions

System Interfacing and

Revision of Products & Services Strategic Market and Process Integration

Offerings to Meet Market Demand Data Intelligence Analytics

Cost Optimisation

Introduction of EXIM Bank’s Leverage Synergies between MGC

Credit Academy and SME Bank’s XCESS Platform Streamline Processes of Pre

vs Post Approval Activities

Customised Credit Rating

and Processes, Targeted Digitalise Legal Process

Programme Lending

Workforce Transformation

Capitalise on Synergies as part of the BPMB Group