Page 56 - EXIM_AR2021

P. 56

54 ENHANCING EXIM BANK MALAYSIA

GOVERNANCE

STATEMENT OF

CORPORATE GOVERNANCE

4) The Board also provides the necessary and requisite overall oversight on the Shariah governance structure and Shariah

compliance of the Bank as required under BNM’s Shariah Governance Framework for Islamic Financial Institutions. The Board,

upon consultation with the Shariah Committee (“SC”) shall approve all policies relating to Shariah matters and is expected to

ensure that such policies are implemented effectively.

The Bank is working towards the implementation of Environmental, Social and Governance (“ESG”) practices. The Bank had recently

set up a Climate Change Task Force Committee (designated Management level) to strategically drive and oversee the implementation

of climate change with respect to business operations, decision making process and risk management practices adopted by the

Bank. The Bank will be guided by internal policies and effective risk management framework that integrates all material risks in

respect to climate change and policies issued by the governing body such as BNM and government agencies.

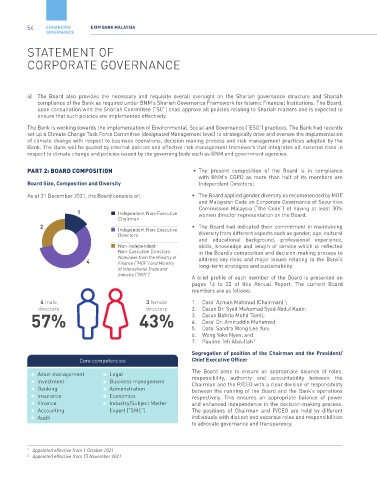

PART 2: BOARD COMPOSITION • The present composition of the Board is in compliance

with BNM’s CGPD as more than half of its members are

Board Size, Composition and Diversity Independent Directors;

As at 31 December 2021, the Board consists of: • The Board applied gender diversity as recommended by MOF

and Malaysian Code on Corporate Governance of Securities

1 Independent Non-Executive Commission Malaysia (“the Code”) of having at least 30%

women director representation on the Board.

Chairman

2 Independent Non-Executive • The Board had indicated their commitment in maintaining

Directors diversity from different aspects such as gender, age, cultural

and educational background, professional experience,

Non-Independent skills, knowledge and length of service which is reflected

Non-Executive Directors in the Board’s composition and decision-making process to

Nominees from the Ministry of

4 Finance (“MOF”) and Ministry address key risks and major issues relating to the Bank’s

of International Trade and long-term strategies and sustainability.

Industry (“MITI”) A brief profile of each member of the Board is presented on

pages 16 to 22 of this Annual Report. The current Board

members are as follows:

4 male 3 female 1. Dato’ Azman Mahmud (Chairman) ;

1

2. Datuk Dr. Syed Muhamad Syed Abdul Kadir;

directors

directors

57% 43% 3. Datuk Bahria Mohd Tamil;

4. Dato’ Dr. Amiruddin Muhamed;

5. Dato’ Sandra Wong Lee Yun;

6. Wong Yoke Nyen; and

7. Pauline Teh Abdullah .

2

Segregation of position of the Chairman and the President/

Core competencies Chief Executive Officer

★ Asset management ★ Legal The Board aims to ensure an appropriate balance of roles,

responsibility, authority and accountability between the

★ Investment ★ Business management Chairman and the P/CEO with a clear division of responsibility

★ Banking ★ Administration between the running of the Board and the Bank’s operations

★ Insurance ★ Economics respectively. This ensures an appropriate balance of power

★ Finance ★ Industry/Subject Matter and enhanced independence in the decision-making process.

★ Accounting Expert (“SME”) The positions of Chairman and P/CEO are held by different

★ Audit individuals with distinct and separate roles and responsibilities

to advocate governance and transparency.

1 Appointed effective from 1 October 2021

2 Appointed effective from 15 November 2021