Page 40 - EXIM-BANK-AR20

P. 40

38 EXIM BANK MALAYSIA

Annual Report 2020

MANAGEMENT DISCUSSION AND ANALYSIS

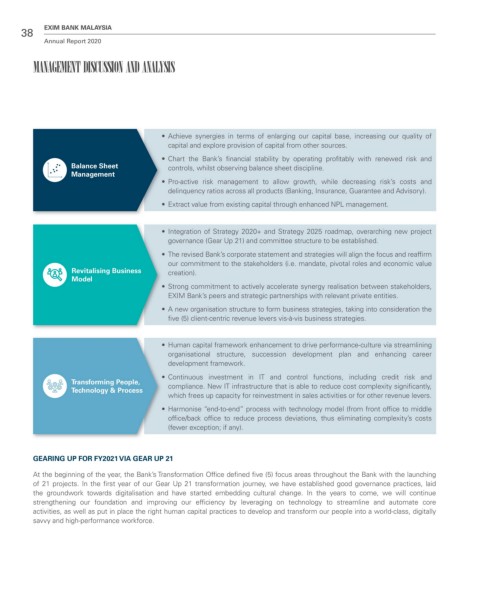

• Achieve synergies in terms of enlarging our capital base, increasing our quality of

capital and explore provision of capital from other sources.

• Chart the Bank’s financial stability by operating profitably with renewed risk and

Balance Sheet controls, whilst observing balance sheet discipline.

Management

• Pro-active risk management to allow growth, while decreasing risk’s costs and

delinquency ratios across all products (Banking, Insurance, Guarantee and Advisory).

• Extract value from existing capital through enhanced NPL management.

• Integration of Strategy 2020+ and Strategy 2025 roadmap, overarching new project

governance (Gear Up 21) and committee structure to be established.

• The revised Bank’s corporate statement and strategies will align the focus and reaffirm

our commitment to the stakeholders (i.e. mandate, pivotal roles and economic value

Revitalising Business creation).

Model

• Strong commitment to actively accelerate synergy realisation between stakeholders,

EXIM Bank’s peers and strategic partnerships with relevant private entities.

• A new organisation structure to form business strategies, taking into consideration the

five (5) client-centric revenue levers vis-à-vis business strategies.

• Human capital framework enhancement to drive performance-culture via streamlining

organisational structure, succession development plan and enhancing career

development framework.

• Continuous investment in IT and control functions, including credit risk and

Transforming People, compliance. New IT infrastructure that is able to reduce cost complexity significantly,

Technology & Process

which frees up capacity for reinvestment in sales activities or for other revenue levers.

• Harmonise “end-to-end” process with technology model (from front office to middle

office/back office to reduce process deviations, thus eliminating complexity’s costs

(fewer exception; if any).

GEARING UP FOR FY2021 VIA GEAR UP 21

At the beginning of the year, the Bank’s Transformation Office defined five (5) focus areas throughout the Bank with the launching

of 21 projects. In the first year of our Gear Up 21 transformation journey, we have established good governance practices, laid

the groundwork towards digitalisation and have started embedding cultural change. In the years to come, we will continue

strengthening our foundation and improving our efficiency by leveraging on technology to streamline and automate core

activities, as well as put in place the right human capital practices to develop and transform our people into a world-class, digitally

savvy and high-performance workforce.