Page 42 - EXIM-BANK-AR20

P. 42

40 EXIM BANK MALAYSIA

Annual Report 2020

MANAGEMENT DISCUSSION AND ANALYSIS

MOVING TOWARDS STRATEGY 2025 MITIGATING RISKS

Strategy 2025 is all about refocusing EXIM Bank to deliver value to our stakeholders. Digitalisation

It embodies EXIM Bank’s long-term ambition to steer the Bank towards greater

resilience and business sustainability. We reaffirm our commitment to being a We are embarking into the era of

preferred DFI for Malaysian businesses seeking financing facilities, insurance/credit digitalisation and digital banking. This

takaful cover and advisory services when conducting business abroad. requires upgrading of the IT core

banking system and infrastructure to

meet accelerating requirements of online

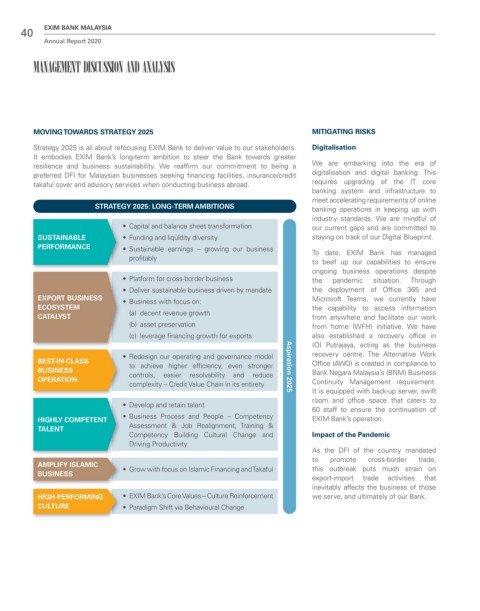

STRATEGY 2025: LONG-TERM AMBITIONS banking operations in keeping up with

industry standards. We are mindful of

• Capital and balance sheet transformation our current gaps and are committed to

SUSTAINABLE • Funding and liquidity diversity staying on track of our Digital Blueprint.

PERFORMANCE • Sustainable earnings – growing our business

profitably To date, EXIM Bank has managed

to beef up our capabilities to ensure

ongoing business operations despite

• Platform for cross-border business the pandemic situation. Through

• Deliver sustainable business driven by mandate the deployment of Office 365 and

EXPORT BUSINESS • Business with focus on: Microsoft Teams, we currently have

ECOSYSTEM the capability to access information

CATALYST (a) decent revenue growth from anywhere and facilitate our work

(b) asset preservation from home (WFH) initiative. We have

(c) leverage financing growth for exports also established a recovery office in

IOI Putrajaya, acting as the business

• Redesign our operating and governance model recovery centre. The Alternative Work

BEST-IN-CLASS to achieve higher efficiency, even stronger Office (AWO) is created in compliance to

BUSINESS controls, easier resolvability and reduce Aspiration 2025 Bank Negara Malaysia’s (BNM) Business

OPERATION Continuity Management requirement.

complexity – Credit Value Chain in its entirety

It is equipped with back-up server, swift

room and office space that caters to

• Develop and retain talent

60 staff to ensure the continuation of

• Business Process and People – Competency

HIGHLY COMPETENT EXIM Bank’s operation.

TALENT Assessment & Job Realignment, Training &

Competency Building Cultural Change and Impact of the Pandemic

Driving Productivity

As the DFI of the country mandated

to promote cross-border trade,

AMPLIFY ISLAMIC • Grow with focus on Islamic Financing and Takaful this outbreak puts much strain on

BUSINESS

export-import trade activities that

inevitably affects the business of those

HIGH-PERFORMING • EXIM Bank’s Core Values – Culture Reinforcement we serve, and ultimately of our Bank.

CULTURE • Paradigm Shift via Behavioural Change