Page 41 - EXIM-BANK-AR20

P. 41

Section 03 Connecting Prospects

39

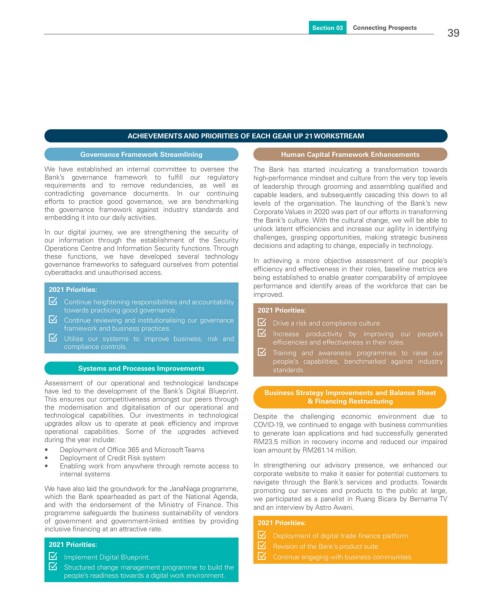

ACHIEVEMENTS AND PRIORITIES OF EACH GEAR UP 21 WORKSTREAM

Governance Framework Streamlining Human Capital Framework Enhancements

We have established an internal committee to oversee the The Bank has started inculcating a transformation towards

Bank’s governance framework to fulfill our regulatory high-performance mindset and culture from the very top levels

requirements and to remove redundancies, as well as of leadership through grooming and assembling qualified and

contradicting governance documents. In our continuing capable leaders, and subsequently cascading this down to all

efforts to practice good governance, we are benchmarking levels of the organisation. The launching of the Bank’s new

the governance framework against industry standards and Corporate Values in 2020 was part of our efforts in transforming

embedding it into our daily activities. the Bank’s culture. With the cultural change, we will be able to

unlock latent efficiencies and increase our agility in identifying

In our digital journey, we are strengthening the security of

our information through the establishment of the Security challenges, grasping opportunities, making strategic business

Operations Centre and Information Security functions. Through decisions and adapting to change, especially in technology.

these functions, we have developed several technology

governance frameworks to safeguard ourselves from potential In achieving a more objective assessment of our people’s

cyberattacks and unauthorised access. efficiency and effectiveness in their roles, baseline metrics are

being established to enable greater comparability of employee

performance and identify areas of the workforce that can be

2021 Priorities:

improved.

Continue heightening responsibilities and accountability

towards practicing good governance. 2021 Priorities:

Continue reviewing and institutionalising our governance Drive a risk and compliance culture.

framework and business practices.

Utilise our systems to improve business, risk and Increase productivity by improving our people’s

efficiencies and effectiveness in their roles.

compliance controls.

Training and awareness programmes to raise our

people’s capabilities, benchmarked against industry

Systems and Processes Improvements standards.

Assessment of our operational and technological landscape

have led to the development of the Bank’s Digital Blueprint. Business Strategy Improvements and Balance Sheet

This ensures our competitiveness amongst our peers through & Financing Restructuring

the modernisation and digitalisation of our operational and

technological capabilities. Our investments in technological Despite the challenging economic environment due to

upgrades allow us to operate at peak efficiency and improve COVID-19, we continued to engage with business communities

operational capabilities. Some of the upgrades achieved to generate loan applications and had successfully generated

during the year include: RM23.5 million in recovery income and reduced our impaired

• Deployment of Office 365 and Microsoft Teams loan amount by RM261.14 million.

• Deployment of Credit Risk system

• Enabling work from anywhere through remote access to In strengthening our advisory presence, we enhanced our

internal systems corporate website to make it easier for potential customers to

navigate through the Bank’s services and products. Towards

We have also laid the groundwork for the JanaNiaga programme, promoting our services and products to the public at large,

which the Bank spearheaded as part of the National Agenda, we participated as a panelist in Ruang Bicara by Bernama TV

and with the endorsement of the Ministry of Finance. This and an interview by Astro Awani.

programme safeguards the business sustainability of vendors

of government and government-linked entities by providing 2021 Priorities:

inclusive financing at an attractive rate.

Deployment of digital trade finance platform.

2021 Priorities: Revision of the Bank’s product suite.

Implement Digital Blueprint. Continue engaging with business communities.

Structured change management programme to build the

people’s readiness towards a digital work environment.